Building a loan screener, tailored education tools, and data-driven CRM workflows for the Wesleyan Investment Foundation (WIF).

Prospects applying before they were ready and no systematic way to nurture leads.

10

Assets for product roadmap, prioritized by impact

10,000+

Data Points to inform stronger customer journeys

20+

Actionable recommendations delivered across journey stage, product, and CRM

Most church leaders have limited financial training, unsure when to seek a building loan or what’s required. This meant applying before they were ready—leading to pauses, declines, or missed guidance.

The WIF team was eager to serve these people, and wanted a research-based process for educating applicants and improving their overall loan experience.

Across two Innovation Sprints, we co-designed and tested WIF’s next generation of digital engagement tools.

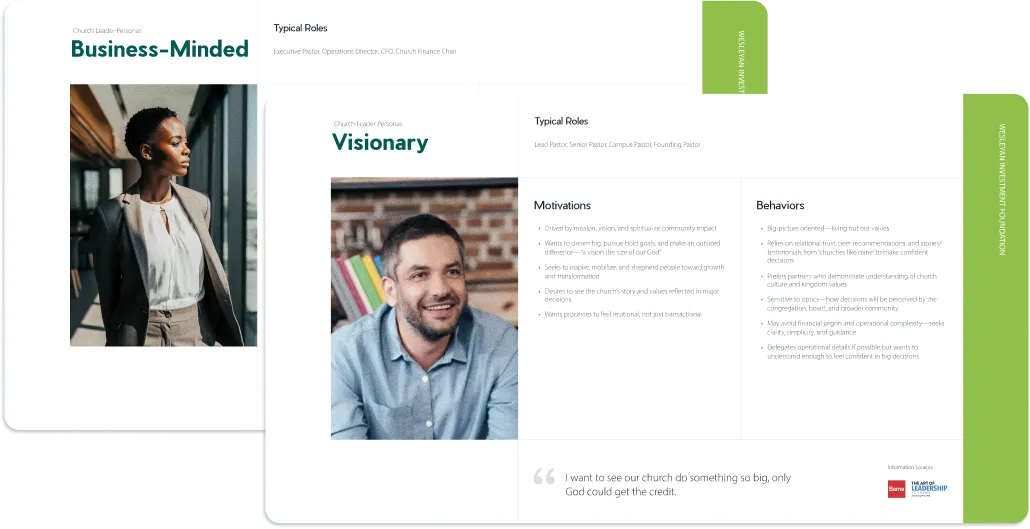

A Simple Persona System That Anchors Decisions — built on 10,000+ data points and ready for CRM tagging, nurture flows, and priority content creation

Detailed CRM Workflow Diagrams — 5 journey maps identifying key customer journey moments where educational resources will have the greatest impact

An Educational Content Experience for Less Experienced Borrowers — answering key questions and clarifying when to apply

Innovation Roadmap — a document with 20+ prioritized actions to reduce drop-off and speed up qualified applications

Defined goals around reducing premature applications, advancing a customer-centered CRM strategy, and creating stage-appropriate education pathways for churches who are considering a loan.

Conducted 30+ in-depth interviews across church sizes and roles; tested prototypes; mapped key outcomes that mattered most to customers at each step of the journey.

Presented persona models, prototype revisions, a CRM framework with tags for the most significant affinity points that form meaningful groups of users and what they need.

Across two Innovation Sprints, we interviewed 33 church leaders spanning diverses roles and church sizes

Interviewees also reflected a wide range of loan experience levels—from first-time borrowers to seasoned leaders overseeing multi-campus capital projects—with loan needs ranging from small renovation efforts to multi-million-dollar building expansions.

This ensured the research captured a broad spectrum of customer data, touching on how churches make decisions and which factors influence pre-mature loan applications, declines, and successful approvals.